A regional principal structure with profits centralised in a tax advantaged jurisdiction

creating a new and transformed income and cash flow stream.optimising overall regional and global tax rates.We have a strategy to help you achieve your goals and align your tax profile with your restructured value chain. PwC's Transfer Pricing Team can assist you in creating appropriate tax and legal structures to optimise your new operating configuration. In order to improve net earnings and cash flow in the evolving global economy, companies can reduce costs and minimise risk by restructuring supply chains and international and domestic operating structures as they globalise. Through our expertise, we have created a set of transfer pricing strategies to assist you in achieving your global business objectives. Stricter penalties, new documentation requirements, increased information exchange, improved training and specialisation are some of the tools used by tax authorities in this global "revenue race".

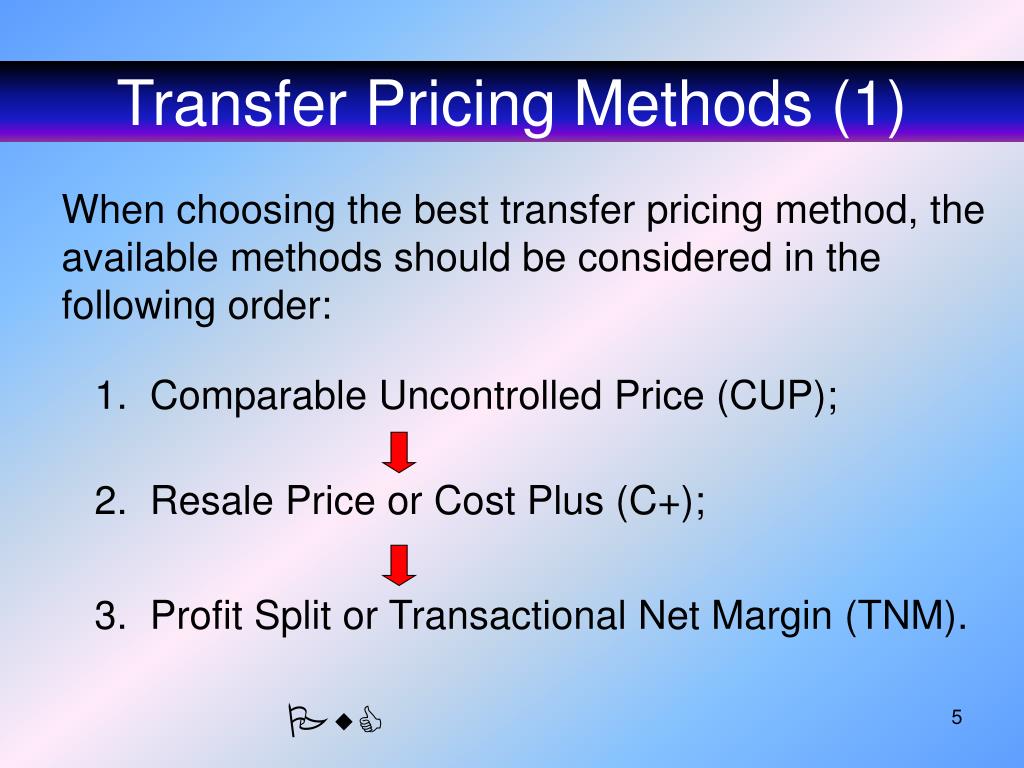

Global integration and new business practices challenge multinational corporations to find innovative transfer pricing solutions. Intercompany transactions across borders are growing rapidly and are becoming much more complex. Transfer pricing is a term used to describe all aspects of intercompany pricing arrangements between related business entities, and commonly applies to intercompany transfers of tangible and intangible property.

0 kommentar(er)

0 kommentar(er)